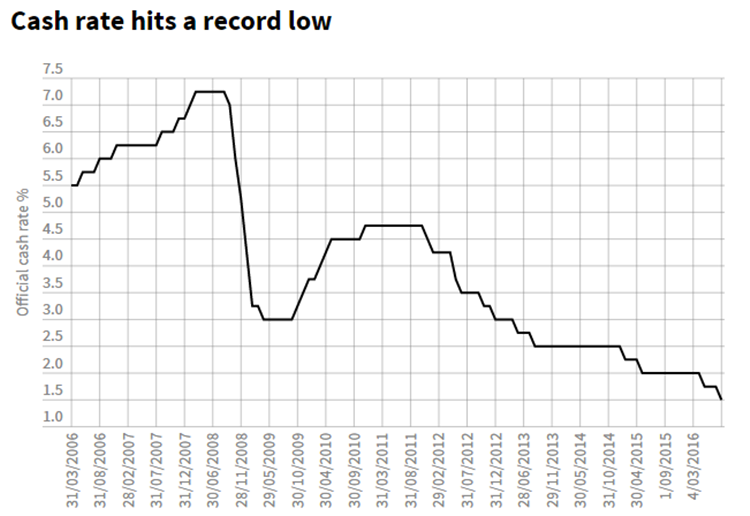

东南网澳大利亚站8月2日综合报道(本站记者 林佳慧)澳联储8月2日下午会议宣布,下调现金利率目标0.25个百分点,从1.75%降至1.5%,创50年来历史新低。

澳联储(Reserve Bank of Australia),资料图

澳联储发布声明称:

尽管近几年全球经济以低于平均速率持续增长,但经济情况对于许多新兴市场经济依旧不容乐观。

商品价格虽然高于近期低点,但这是建立在近几年的商品价格大幅下降的基础之上。澳大利亚的进出口交换比率同近年相比,仍然较低。

从澳大利亚近期的数据表明,由于世界其他地区低水平的人工成本增长及降低的成本压力,通胀预计在在一段时间内将维持在相当低的水准。

图为2006年至今RBA现金利率曲线图,资料图

低利率致使加剧房地产市场风险的可能性降低

澳元汇率升值将使得经济调整复杂化,因此,各项因素均要求通过必要的经济政策调节,来达到改善经济状况的目的。

据彭博社此前的调查表明,此次降息符合预期。80%的分析师认为,为了应对通胀偏低及澳元汇率上涨,澳联储将有必要放宽货币政策来刺激澳洲经济的可持续增长。

这是澳联储三个月以来的第二次降息。今年5月3日,为了应对通胀放缓,澳洲联储宣布降息25个几点,打破了一年来按兵不动的局面。

Reserve Bank of Australia cuts interest rates to record low of 1.5 per cent

By Jessie, Southeast Net Australia, 2nd August

The Reserve Bank has cut rates to a new historic low of 1.5%. The statement by Glenn Stevens, announcing that the Board decided to lower the cash rate by 25 basis points to 1.50 per cent, effective 3 August 2016.

The global economy is continuing to grow, at a lower than average pace. While conditions have become more difficult for a number of emerging market economies.

Commodity prices are above recent lows, but this follows very substantial declines over the past couple of years. Australia's terms of trade remain much lower than they had been in recent years.

Recent data confirm that inflation remains quite low. Given very subdued growth in labor costs and very low cost pressures elsewhere in the world, this is expected to remain the case for some time.

The likelihood of lower interest rates exacerbating risks in the housing market has diminished.

These factors are all assisting the economy to make the necessary economic adjustments, though an appreciating exchange rate could complicate this.

The Bloomberg survey showed that 80% of Economists had predicted a rate cut today. To prospects for sustainable growth in the economy, with inflation returning to target over, would be improved by easing monetary policy at this meeting.