SYDNEY, May 11 (Xinhua) -- The Australian dollar has firmed overnight on a bounce in oil and higher global equity markets.

At the Asian open on Wednesday, the local unit was trading at 73.62 U.S. cents, up from 73.42 U.S. cents at Tuesday's close.

Benchmark crude firmed overnight despite API oil inventory data increasing, giving an early indication of U.S. stocks, as renewed militant attacks on Nigeria's oil infrastructure and Canada's wild fires curb global production.

The bounce in oil spurred gains in industrial commodities and offshore equities, supporting the Australian dollar against the majors despite the unit remaining under pressure as expectations grow of further central bank cuts.

"These expectations should continue to keep a lid on near-term Australian dollar upside," Commonwealth Bank of Australia senior currency strategist Elias Haddad said, expecting the unit to fall to the mid 72 U.S. cent range.

At 0958 local time (AEST) the Australian dollar had firmed to 73.70 U.S. cents.

《土楼回响》在澳洲掀起文化热浪

《土楼回响》在澳洲掀起文化热浪 【走进内阁】认识澳大利亚最高级别的政府官员(一)

【走进内阁】认识澳大利亚最高级别的政府官员(一) 【90后看大佬】 “侨送光明,医济侨胞,借船出海”——澳洲康平国际医疗集团总裁陈星惠医生专访

【90后看大佬】 “侨送光明,医济侨胞,借船出海”——澳洲康平国际医疗集团总裁陈星惠医生专访 【90后看大佬】林辉源的“三不人生”

【90后看大佬】林辉源的“三不人生” 福建省侨办领导会见东南网澳大利亚站代表团

福建省侨办领导会见东南网澳大利亚站代表团 【90后看大佬】“左右合并”的幸福人生——澳洲潮州同乡会会长李国兴

【90后看大佬】“左右合并”的幸福人生——澳洲潮州同乡会会长李国兴 澳大利亚非银行贷方暂停放贷 海外借贷人寸步难行

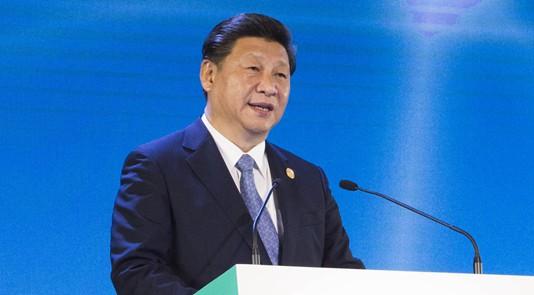

澳大利亚非银行贷方暂停放贷 海外借贷人寸步难行 习近平总书记系列重要讲话读本(2016版) 十五、推动构建以合作共赢为核心的新型国际关系 ——关于国际关系和我国外交战略

习近平总书记系列重要讲话读本(2016版) 十五、推动构建以合作共赢为核心的新型国际关系 ——关于国际关系和我国外交战略 男篮热身赛 中国队不敌澳大利亚

男篮热身赛 中国队不敌澳大利亚 “洋空气”瞄准中国市场:商业机遇还是商业炒作?

“洋空气”瞄准中国市场:商业机遇还是商业炒作? 澳政府拟拨款百万筹备春节活动:吸引中国游客

澳政府拟拨款百万筹备春节活动:吸引中国游客 英媒:中国完成由资本输入国到资本输出国重大转变

英媒:中国完成由资本输入国到资本输出国重大转变